-

NO TERMINAL FEES

NO Merchant FEES

NO Software FEES

NO Internet FEES

-

NO TERMINAL FEES

NO Merchant FEES

NO Software FEES

NO Internet FEES

-

NO TERMINAL FEES

NO Merchant FEES

NO Software FEES

NO Internet FEES

-

NO TERMINAL FEES

NO Merchant FEES

NO Software FEES

NO Internet FEES

Every dollar from every transaction is yours

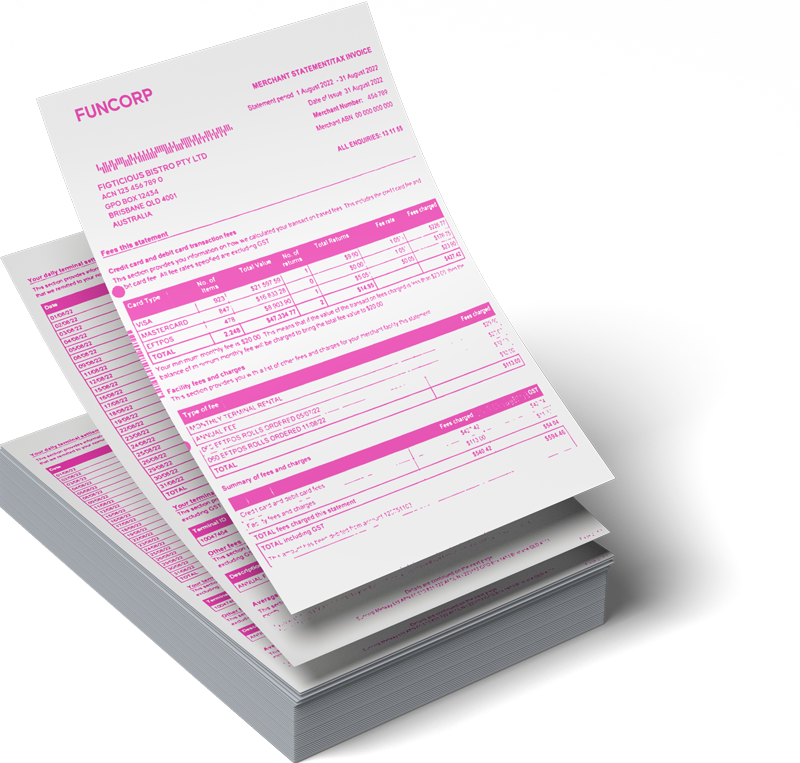

No more monthly bank Merchant invoices

The monthly deduction of merchant fees from your bank account will no longer apply. Every dollar you make is yours to pay your bills.

No more monthly POS Software invoices

POS monthly software licensing fees where POS and Eftpos are integrated is an essential element of the card accepting model.

No more monthly Internet invoices

Using BOSSII you wont have to ever concern yourself ever again with not only the initial painful exercise of having to schedule an NBN technician but also ongoing monthly fees.

Pay by BOSSII

If your turnover is greater than $1m per year, our “Pay by BOSSII” option is a perfect solution for both operational reasons and profitable advantages.

All up an average saving of $18,000py for a venue turning over around $1m per year. That’s a 1.8% ADDITION to your yearly bottom line profit just by choosing the right solution. This is a no brainer decision that any Brisbane, Gold Coast or Sunshine Coast business should look in to if it fits your philosophy.

Bossii completes your business puzzle

What do you get for $0

| $0 Outlay Option | Merchant Fee (typical average) |

|

|---|---|---|

| Monthly Fees | $0 | $833.33 |

| EFT Terminal Rental Fees (3) | $0 | $100.00 |

| POS fees (5) | $0 | $500.00 |

| Internet fees ** | $0 | $70.00 |

| Pay by BOSSII per month | $0 | |

| Rest of Australia per year | $18040.00 | |

|

* assuming $1m turnover |

You immediately have an $18k advantage over all your competitors

What do others think?

“This new method of bundling all the pieces of POS into one method is a great addition to our business and to my own sanity. I no longer have to deal with big inflexible businesses and sit on hold for hours to arrange all 4 of these elements. Now I just make a call to the BOSSII team and it's arranged quickly and without ongoing cost to me.

I can highly recommend you look into this also”

FAQs

Any business is eligible however to gain full NO cost neutrality a business with a card turnover of $1m per year at a minimum would see the full benefits of the Pay by BOSSII model

BOSSII will determine this with you with the benefit of knowing the following items:

- Your monthly card turnover

- The amount of hardware terminals required

- Your monthly average transaction value

- Your current or future POS licence card integration fees

- Your blend of cards that are currently being accepted

Should you not have all of this information, our team are experienced enough to determine an appropriate rate, that along with you, will cover the full cost of acceptance. We then monitor this rate over a number of months to determine if the rate is covering your full cost of acceptance. If it has been set too high then we can reduce that rate and if too low we can increase it as required.

All settlements can be sent to any Australian registered business bank account that you choose to settle to. There is no need to open a new bank account for settlements.